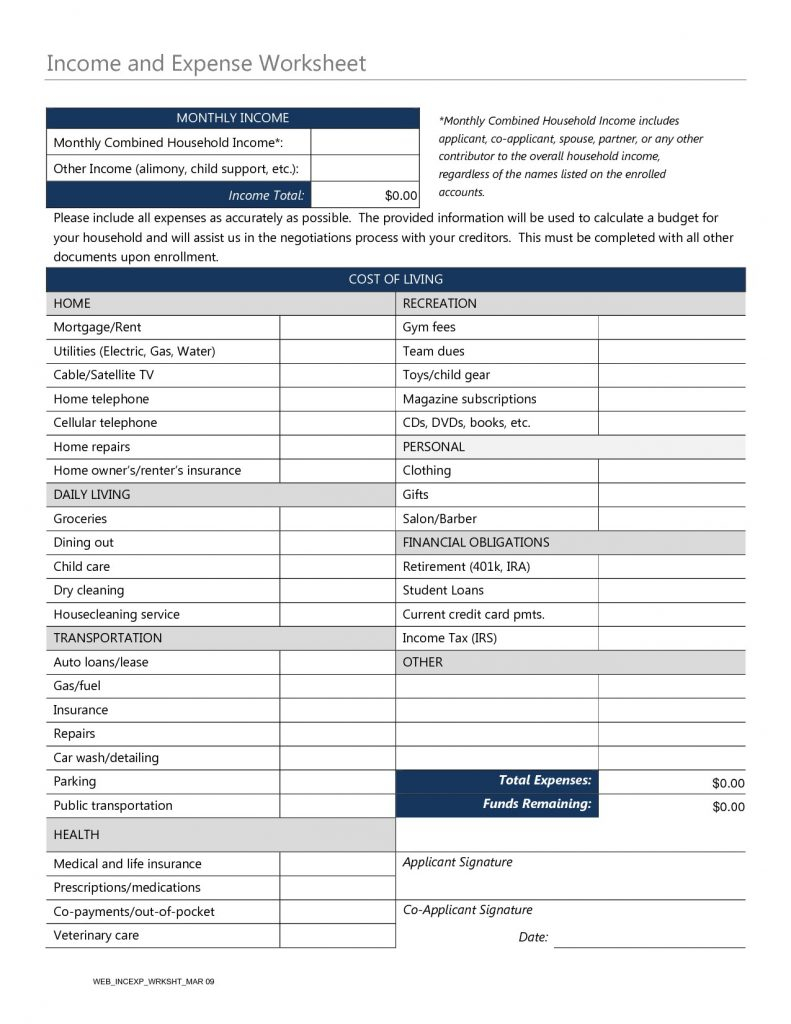

MONTHLY EXPENSES WORKSHEET TV

Personal and family: Cellphone bills, entertainment-including TV streaming services like Netflix and other subscriptions like Spotify-fitness, pet expenses, household supplies, personal care (haircuts, toiletries, etc.), and clothing.Also include any student loan payments you have. for children in K-12 and adults going to college. Education: Tuition, supplies, fees, etc.Transportation: Public transportation like buses, but also car-related expenses, including your monthly loan payment, repairs, insurance, tolls, and fuel.Food: What you spend on food from the grocery store, eating out at restaurants, getting takeout, or meal delivery services.

You can also account for other necessary housing-related expenses, like utility bills, homeowners or renters insurance, and maintenance bills. Housing: Your rent or mortgage payment.Income: Your total take-home income, including any money you earn from side hustles, alimony, child support, part-time jobs, etc.

0 kommentar(er)

0 kommentar(er)